What is StEME?

StEME is the Student Entitlement Management Engine. StEME is a component of TCSI that is responsible for:

- creating student loans

- calculating a student's HELP balance

- checking whether student loans can be covered by the student's HELP balance

- maintaining a 'loan status' so providers can see where a loan is in the loan management process

- sending loans to the ATO

- adjusting a student's HELP balance when loan repayment data is received from the ATO, and

- updating loans when loan related data is reported or amended by providers.

This document provides a high level description of StEME's loan management process and what each 'loan status' means.

As data is submitted, TCSI will undertake a range of real-time validation (RTV) checks. RTVs check that any new data reported by a provider is internally consistent with data that the provider has previously reported. For example, if a provider reported that a student is an international student and then subsequently tries to report a loan for that student, the system will recognise the data inconsistency; will prevent the new data from being stored; and will immediately return an error message to help the provider resolve the source of the error.

StEME will create a loan as soon as the provider successfully reports* a unit enrolment packet where:

- there is enough information on the linked student record to uniquely identify the student and either verify or issue a Commonwealth Higher Education Student Support Number (CHESSN) for the student

- the student status code (E490) indicates that the student will access a HECS-HELP, FEE-HELP or VSL loan to pay their student contributions or tuition fees for the unit of study, and

- the loan amount (E558) is greater than 0.

This means that a provider must successfully report E490, E558 and all the minimum data elements for a unit enrolment packet plus sufficient identifying data on the linked student record for a CHESSN to be generated before StEME will create a loan.

*Successfully reports means to report data that passes all the applicable RTV checks and is then stored in the TCSI database.

Once StEME has created a loan record, it will conduct a serviceability check, which works out whether the loan amount (E558) can be covered by the student’s HELP balance. This involves putting all the loans a student has at all providers in the order in which the loans will consume the student’s HELP balance. Loans with an earlier census date consume balance before loans with a later census date. Where there are loans with the same census date, they will be processed in the order they were created or last amended.

Once the loans are put in this ‘order of precedence’, StEME sequentially checks each loan against the student’s HELP balance and sets a ‘loan status’ (see the table below) for each loan based on whether the student has balance to either fully or partially service the loan.

TCSI enables providers to report loan related data as soon as a student has indicated that they want a loan for a unit of study that they are enrolled in. Early reporting is encouraged as this will give providers early feedback on whether loans will be serviceable. However, providers have until 14 days after the census date to report loan data, which means that StEME won’t have a complete picture of all loans for a census date until 15 days after that census date.

For this reason, loans will have a ‘pending’ loan status until 14 days after the census date. Although the loan status does not change on the census date, the student’s HELP balance will be adjusted by the value of the loan on the census date. HECS-HELP and FEE-HELP loans will receive a non-pending status 15 days after the census date. VSL loans move to a non-pending status after other checks in Stage 4.

|

Loan status |

Description |

|

Acceptance pending |

|

|

Adjustment pending |

|

|

Rejection pending |

|

|

15 days after census date |

|

|

Accepted |

|

|

Adjusted |

|

|

Rejected |

|

For VET Student Loans (VSL), the loan status will not automatically change from a pending to a non-pending status 15 days after the census date. All 'pending' VSL loans are subject to further eligibility checks such as VSL course loan limit checks and the outcome of these checks is indicated in the loan status once those checks are completed.

| Loan status | Description |

|---|---|

|

VET approved |

|

|

VET rejected |

|

Under the reporting requirements, providers should have reported all data for loans within 14 days after the census date. This may not always be possible, for example, the student's Tax File Number (TFN) may not be available if a student is accessing a loan based on an ATO certificate of application for a TFN. Messages will be placed on the provider's notification table where TCSI identifies that data has not been reported by the reporting deadline. See Scheduled Validations.

A loan will be sent to the ATO as soon as the:

- provider successfully reports all the data that is relevant to a student's eligibility for a loan (such as the citizen resident code) and the data needed to send a loan to the ATO (for example, TFN), and

- loan status is 'accepted', 'adjusted' or 'VET approved'.

The following loan statuses will apply as loans are sent to and received by the ATO:

| Loan status | Description |

|---|---|

|

Accepted in transit |

The reported loan has been sent to the ATO |

|

Adjusted in transit |

The adjusted loan has been sent to the ATO |

|

Committed |

The ATO has acknowledged receipt of the reported loan |

|

Adjusted committed |

The ATO has acknowledged receipt of an adjusted loan |

If a provider successfully reports a change to a loan type by amending the student status code (E490), the loan amount (E558) or the census date (E489) on the unit enrolment record, StEME will re-assess the serviceability of that loan and all loans with a lower precedence. The loan status will be updated if needed and, if the original loan record was sent to the ATO, StEME will send any necessary amendments to the ATO.

Although providers can report a loan up to 14 days after the census date, payment arrangements for student contributions and tuition fees are to be final by the census date. This means that once a loan status has been set to:

- 'adjusted', StEME will not increase the loan amount due to changes to other loans held by the student but it will reduce the loan amount or reject the loan if needed to stop a student from exceeding their HELP limit

- 'rejected', StEME cannot un-reject the loan due to changes to other loans held by the student.

If a loan is found to be unserviceable after the loan has been sent to the ATO, the ATO will be advised and the loan will have a loan status of 'invalidated'. If the loan is found to be unserviceable before the loan was sent to the ATO, it have a loan status of 'rejected' and the original loan will never be sent to the ATO.

If a loan is found to be partially unserviceable after the loan has been sent to the ATO, the original loan will be 'invalidated' and StEME will create a new loan with the adjusted loan amount to send to the ATO, with a final status of 'adjusted committed'.

| Loan status | Description |

|---|---|

|

Invalidated in transit |

The ATO has been asked to remove the loan as it was found to be unserviceable. |

|

Invalidated |

The ATO has removed the loan as it was found to be unserviceable. |

StEME will delete a loan record if a provider successfully changes the student status code (E490) to a non-loan code, sets the loan amount (E558) to 0, sets the unit of study outcome date (E601) to be on or before the unit of study census date (E489), or deletes the linked unit enrolment record. When a loan is deleted, StEME will re‑assess the serviceability of all pending loans with a lower precedence.

If the deletion of a loan occurs after the loan has been sent to the ATO, the ATO will be advised and the loan will have a loan status of 'reversed'. If the loan is deleted before the loan was sent to the ATO, it will retain a loan status of 'deleted' and will never be sent to the ATO.

| Loan status | Description |

|---|---|

|

Deleted |

The loan was deleted before the original loan was sent to the ATO. |

|

Reversal received |

The loan was deleted after the original loan was sent to the ATO. |

|

Reversed in transit |

The ATO has been asked to remove the loan as it was deleted. |

|

Reversed |

The ATO has removed the loan as it was deleted. |

If a provider successfully reports a value for the remission reason code (E446), StEME will re-assess the serviceability of pending loans with a lower precedence.

If the remission is received after the loan has been sent to the ATO, the ATO will be advised and the loan will have a loan status of ‘remitted’. If the remission is received before the loan was transmitted to the ATO, it will have a loan status of ‘remission’ and will never be sent to the ATO.

|

Loan status |

Description |

|

Remission |

A remission has been received for the loan before the loan was sent to the ATO. |

|

Remitted received |

The loan was remitted after the loan was sent to the ATO. |

|

Remitted in transit |

The ATO has been asked to remove the loan as it was remitted. |

|

Remitted |

The ATO has removed the loan as it was remitted. |

Loan repayment data from the ATO will be available to StEME on a monthly basis. StEME will reassess the serviceability of all loans with a census date on or after the day that repayment data is received. This could lead to loans with a status of ‘rejection pending’ being upgraded to ‘adjustment pending’ or ‘acceptance pending’ or loans with a status of ‘adjustment pending’ being upgraded to ‘acceptance pending’.

A message will be placed on the provider’s notification table when there is a change to a loan that the provider needs to know about, including when the:

- loan is assessed as ‘adjustment pending’ or ‘rejection pending’

- status of the loan is downgraded, for example, its status changes from ‘acceptance pending’ to ‘adjustment pending’ or ‘committed’ to ‘invalidated’, etc.

- status of the loan is upgraded, for example, its status changes from ‘rejection pending’ to ‘adjustment pending’, or from ‘adjustment pending’ to ‘acceptance pending’, etc.

A message will not be placed in the provider’s notification table for a ‘business as usual’ progression of a loan or for loan changes initiated by the provider. For instance, messages are not created when a loan:

- is created and its status is set to ‘accepted’ or ‘acceptance pending’

- is deleted as the result of the provider deleting the unit enrolment, amending the loan amount (E558) to nil, or the student status code (E490) to a non-loan code

- is remitted

- moves through the loan lifecycle without being upgraded or downgraded as the result of StEME reassessing the serviceability, for example, the loan status changes from ‘acceptance pending’ to ‘accepted’ to ‘committed’, or from ‘rejection pending’ to ‘rejected’, etc.

For providers using APIs, the loan statuses for each of their loans can be obtained through the Loans API endpoint. For providers using TCSI Data Entry, loan statuses can be obtained through the unit enrolment record.

TCSI Analytics hosts reports that contain the A130 status, such as the Higher Education Unit of Study Unit Records and VET Student Loans Live Data Report reports.

You can also request a data extract to view the Loan status (A130) in the unit enrolment packet. Please note that for higher education loans data that was migrated from HEIMS, the loan details will be located in the Academic Organisational Unit (AOU) packet.

Loan statuses that can change

The below loan statuses may change over time and are likely to be the current status for loan attached to a unit enrolment record (e.g. an ACCEPTED loan is COMMITTED at the ATO and later REVERSED)

| ACCPEND | Loan pending acceptance |

| ADJPEND | Loan pending adjustment |

| REJECTPEND | Loan pending rejection |

| ACCEPTED | Loan accepted in TCSI (not yet transmitted to ATO) |

| ADJUSTED | Loan amount reduced – HELP limit reached (not yet transmitted to ATO) |

| COMMITTED | Loan received by ATO |

| ADJCOMMITTED | Adjusted loan received by ATO |

| REMITREC | Remitted received (for loans that have been sent to the ATO) |

| REVERSREC | Reversal received (where original loan was sent to the ATO) |

| ACCTRANS | Accepted loan in transit to ATO |

| ADJTRANS | Adjusted loan in transit to ATO |

| INVALIDTRANS | Invalidated loan in transit to ATO |

| REVERSETRANS | Reversed loan in transit to ATO |

| REMITTTRANS | Remitted loan in transit to ATO |

| VETAPPROVED | VET loan approved by VPAYS (not yet transmitted to ATO) |

Final loan statuses

These loan statuses are final. Changes to a unit enrolment record that re-creates a loan will trigger TCSI to create a new loan record (not an update to a deleted, remitted or reversed loan). Where a unit enrolment has more than one loan status, the statuses below will not be current.

| DELETED | Loan deleted (where original loan was not sent to the ATO) |

| VETREJECTED | VET loan rejected by VPAYS |

| REMISSION | Remission (for loans that have not been sent to the ATO) |

| REVERSED | Reversal of committed loan received by ATO |

| REMITTED | Loan remitted at the ATO |

| REJECTED | Loan rejected – HELP limit reached |

| INVALIDATED | Loan invalidation received by ATO |

The sooner providers report student records and unit enrolments records, the sooner StEME can check student loans for serviceability and the sooner providers will have access to information about whether the loan will be payable by the Government or whether the provider will need to seek upfront payment from a student.

Providers have until 14 days after the census date to report loan data but delayed reporting is not recommended where it is avoidable. Delays in the reporting of data reduces the amount of time providers will have to identify students who will not be able to finance their study with a HELP or VSL loan, especially students who may be concurrently enrolled at more than one provider.

Administrative errors that result in the reporting or amendment of loan data more than 14 days after the census data can have an adverse impact on students and other providers the student may be enrolled with. Providers should note that legislative sanctions are available and may be used where providers frequently report and amend loans data after the reporting deadline.

Changes to a unit enrolment record that re-creates a loan will trigger TCSI to create a new loan record and not perform an update to a DELETED, REMITTED or REVERSED loan record. Where a unit enrolment has more than one loan status, final loan statuses will not be the current loan record for the unit enrolment.

|

Scenario A unit enrolment that was reported with HELP loan was deleted in error before the census date (Loan one). The unit enrolment was re-reported and the loan received an A130 loan status of COMMITTED after the census date (Loan two). The provider noticed an error with the reported HELP Loan amount (E558) and adjusted the record to reflect the correct amount. This triggered the system to reverse loan two and create a new loan (Loan three) with the corrected amount and an A130 loan status of COMMITTED. |

In the above scenario, a number of changes have occurred to the unit enrolment record which has triggered the creation of multiple loan records. Loan three is the current active loan record for the unit enrolment record because it has an active A130 loan status of 'COMMITTED'.

| Loan Record | Action | Result | A130 Loan Status |

|---|---|---|---|

| Loan One | Unit enrolment record was deleted before the unit of study census date (E489) due to an admin error | Loan was deleted before it was sent to the ATO | DELETED |

| Loan Two | Unit enrolment was re-reported. After the associated loan record received an A130 loan status of COMMITTED, the provider noticed an error and amended the HELP loan amount (E558) to the correct value. | Loan record was reversed at the ATO | REVERSED |

| Loan three (current) | Unit enrolment record reported with the amended HELP loan amount (E558). | Loan is committed at the ATO with the amended HELP loan amount (E558) | COMMITTED |

The following examples show how the loan status changes through the loan life cycle depending on the serviceability of the loan and loan updates sent by providers.

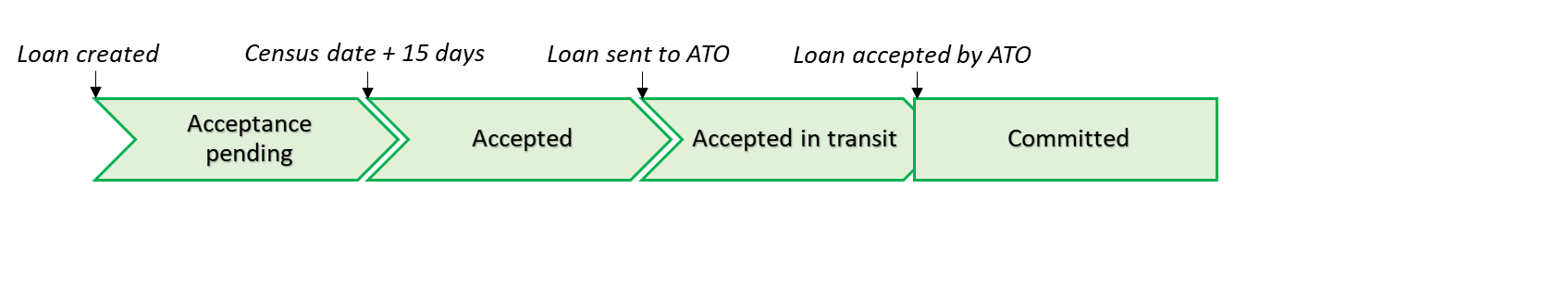

Example 1: Loan is reported before the census date, is fully serviceable through the loan life cycle

Within the diagram, there is a loan creation date, which shows "Acceptance pending" until after Census date + 15 days when it becomes "Accepted". The loan is then sent to the ATO, changing its status to "Accepted in transit". Once the loan is accepted by the ATO the status becomes "Committed".

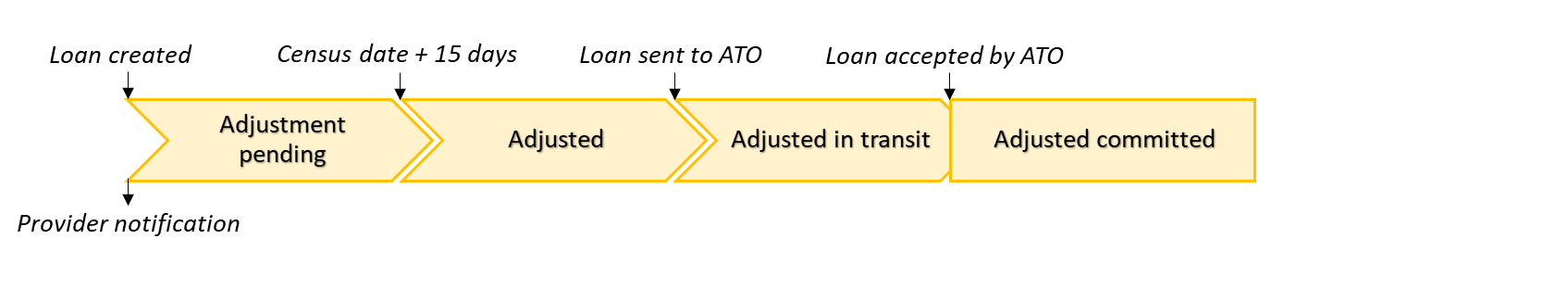

Example 2: Loan is reported before the census date and is partially serviceable through the loan life cycle

Within the diagram, there is a loan creation date, which if only partially serviceable shows a "Adjustment pending" status. After Census date + 15 days loan is shown as adjusted, and after it is sent to the ATO that status becomes "Adjusted in transit". Once the loan is accepted by the ATO the status becomes "Adjusted committed".

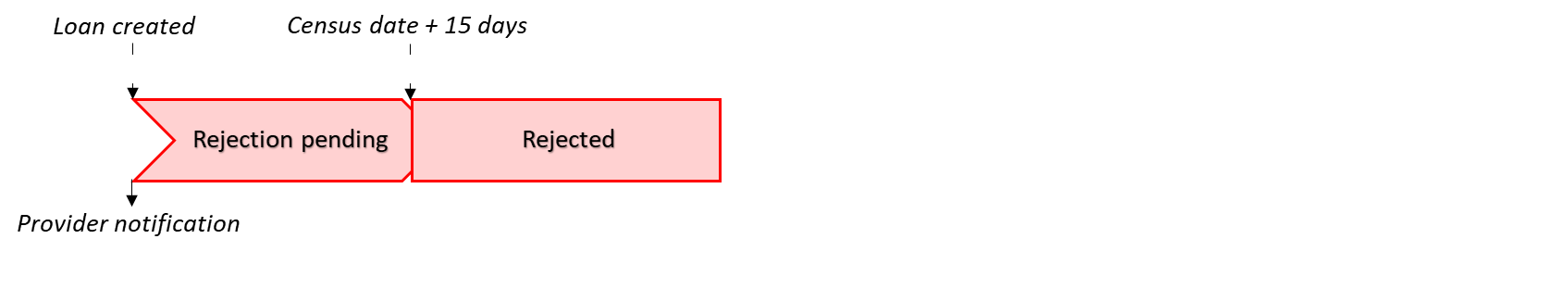

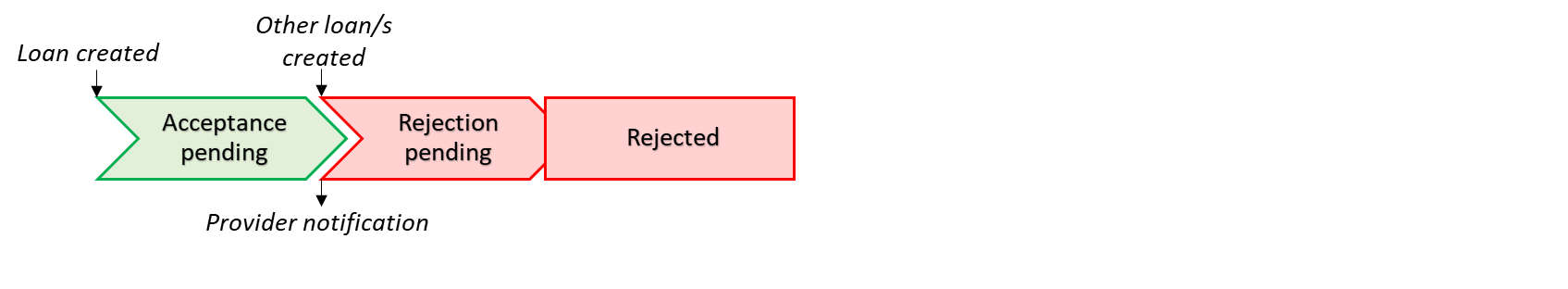

Example 3: Loan is reported before the census date and is unserviceable and remained so up to the reporting deadline

Within the diagram, there is a loan creation date, which if unserviceable shows a "Rejection pending" status until the census date + 15 days, thereafter it is shown as "Rejected".

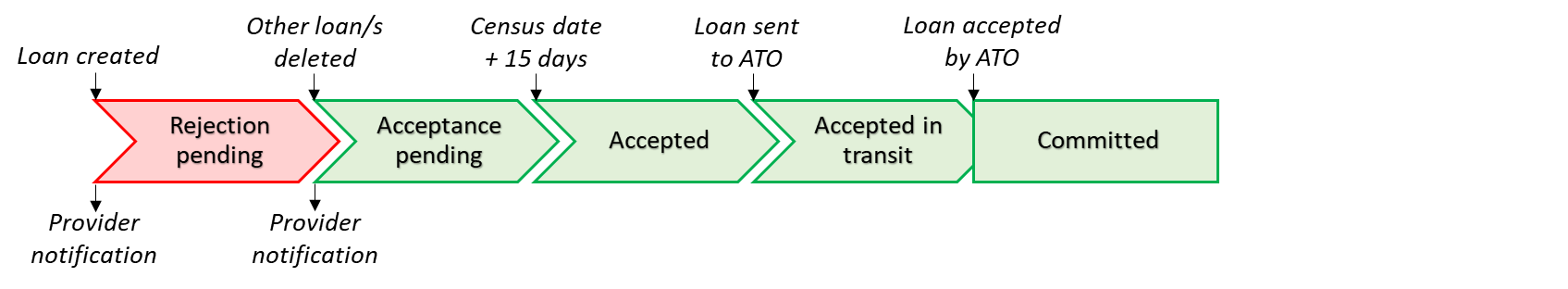

Example 4: Loan started as unserviceable but the deletion of other loans before the reporting deadline made the loan serviceable

Within the diagram, there is a loan creation date, which if unserviceable shows a "Rejection pending" status. Once the action of deleting other loans is taken, the status is changed to "Acceptance pending". After Census date + 15 days loan is shown as accepted, and once sent to the ATO, loan is shown as "Accepted in transit". Finally once the loan is accepted by the ATO, the status is shown as "Committed".

Example 5: Loan started as fully serviceable but the reporting of other loans before the reporting deadline made the loan unserviceable

Within the diagram, there is a loan creation date, which shows "Acceptance pending" until the creation of another loan/s, this changes the status to "Rejection pending", which after Census date + 15 days becomes "Rejected".

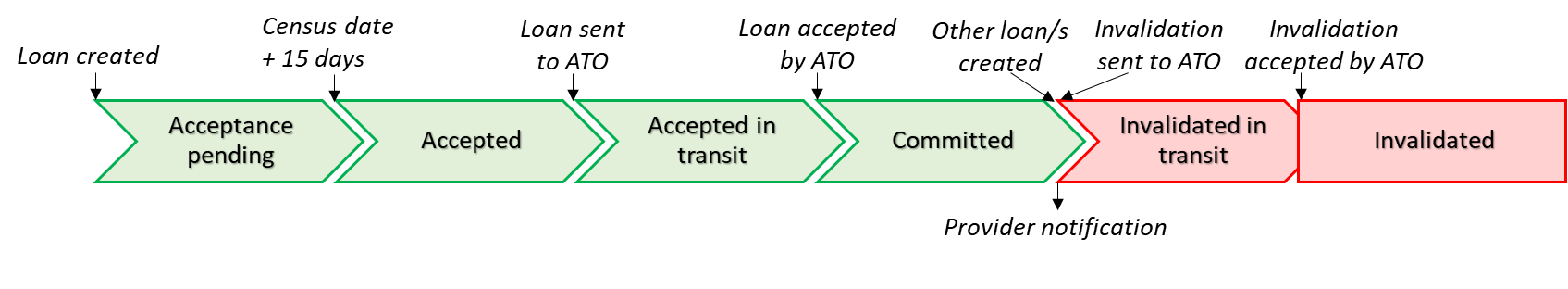

Example 6: Loan started as fully serviceable but the reporting of other loans after the loan was sent to the ATO made the loan unserviceable

Within the diagram, there is a loan creation date, which shows "Acceptance pending". After Census date + 15 days, the status of the loan becomes "Accepted", which is then sent to the ATO changing the status to "Accepted in transit". Once accepted by the ATO, the loan is noted as "Committed", but if another loan is created at this point an invalidation is sent through to the ATO. The loan status then changes to "Invalidated in transit", and once the invalidation is accepted by the ATO it becomes "Invalidated".

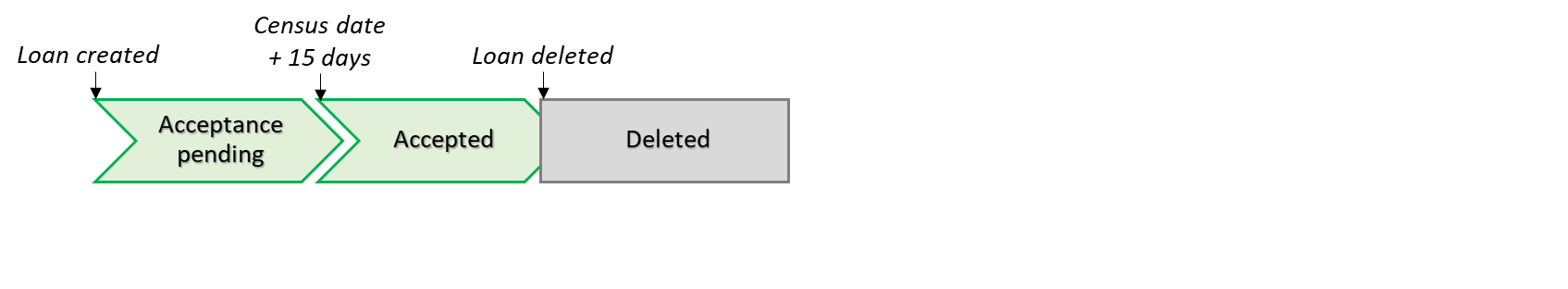

Example 7: Loan was fully serviceable but was deleted before the loan was sent to the ATO

Within the diagram, there is a loan creation date, which shows "Acceptance pending". After Census date + 15 days, the status of the loan becomes "Accepted". However, if the loan is then deleted at this point, before it can be sent to the ATO, the status of the loan changes to "Deleted".

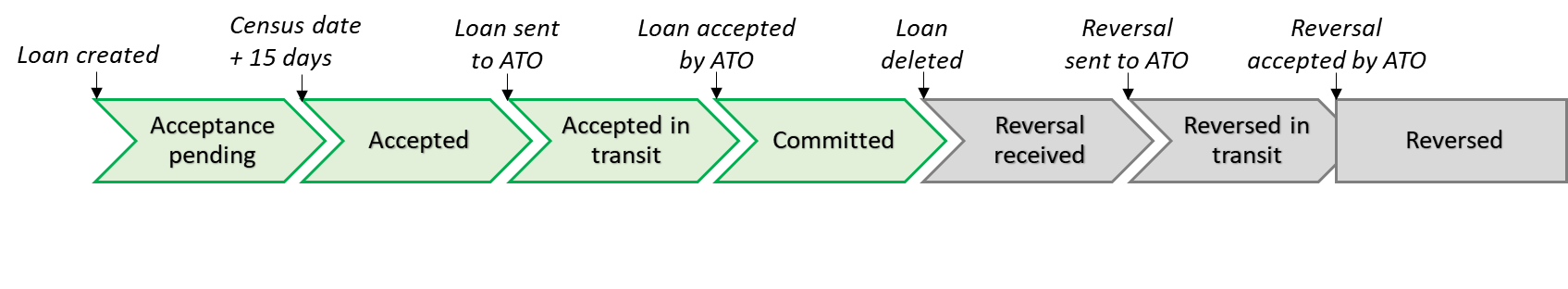

Example 8: Loan was fully serviceable but was deleted after the loan was sent to the ATO

Within the diagram, there is a loan creation date which shows an "Acceptance pending" status. After Census date + 15 days loan is shown as accepted, and once sent to the ATO, loan is shown as "Accepted in transit". Once the loan is accepted by the ATO, the status is shown as "Committed". If the loan is deleted at this stage, the status changes to "Reversal received", and once the reversal is sent to the ATO it changes again to "Reversed in transit". Finally, once the reversal is accepted by the ATO, the loan status changes to "Reversed".

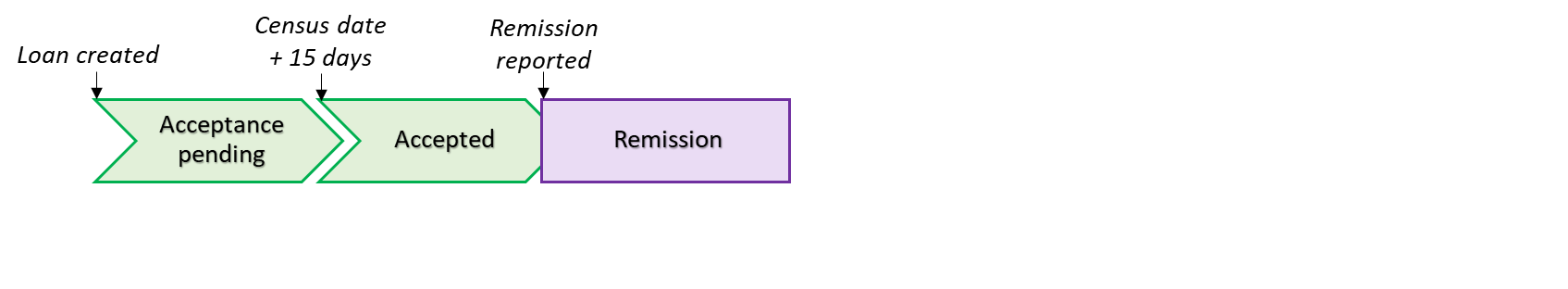

Example 9: Loan was fully serviceable but was remitted before the loan was sent to the ATO

Within the diagram, there is a loan creation date, which shows "Acceptance pending". After Census date + 15 days, the status of the loan becomes "Accepted". However, if the loan is reported as having a remission at this point, before it can be sent to the ATO, the status of the loan changes to "Remission".

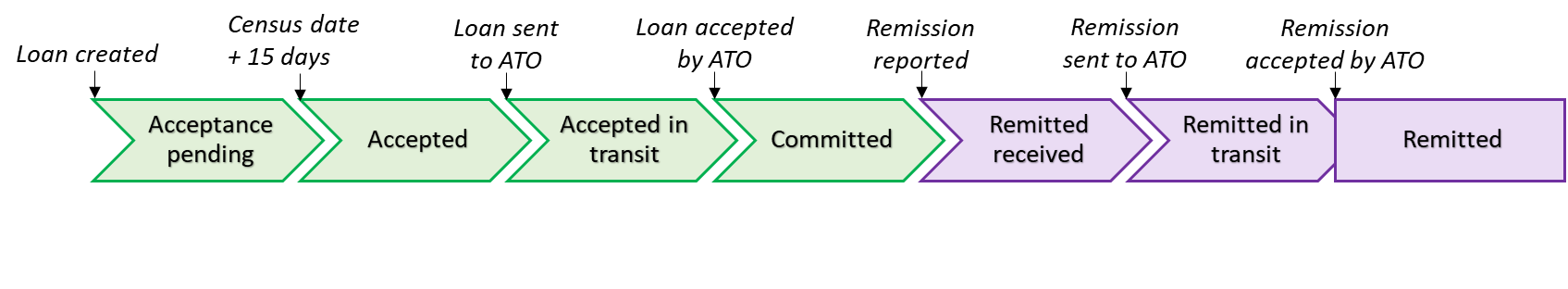

Example 10: Loan was fully serviceable but was remitted after the loan was sent to the ATO

Within the diagram, there is a loan creation date, which shows "Acceptance pending". After Census date + 15 days, the status of the loan becomes "Accepted". However, if the loan is reported as having a remission at this point, before it can be sent to the ATO, the status of the loan changes to "Remission".

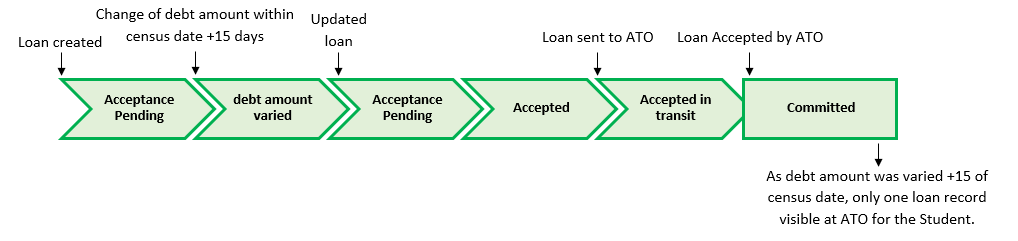

Example 11: Loan varied within 14 days of the census date

In this example, the loan amount is increased or decreased within 14 days of the census date while the loan was still in ACCPEND or ADJPEND status and had not been COMMITTED at the ATO. As the variation occurred before the loan was sent, only one record for the loan will be visible by the student when checking at the ATO.

Loan varied after COMMITTED at the ATO

A change to a unit enrolment record that changes or reinstates a loan will trigger TCSI to create a new loan record. TCSI will not update a final loan status. The list of final loan statuses can be found at Loan status (A130) codes. Where a unit enrolment has more than one loan status, the loans with a ‘final loan status’ will not be current.

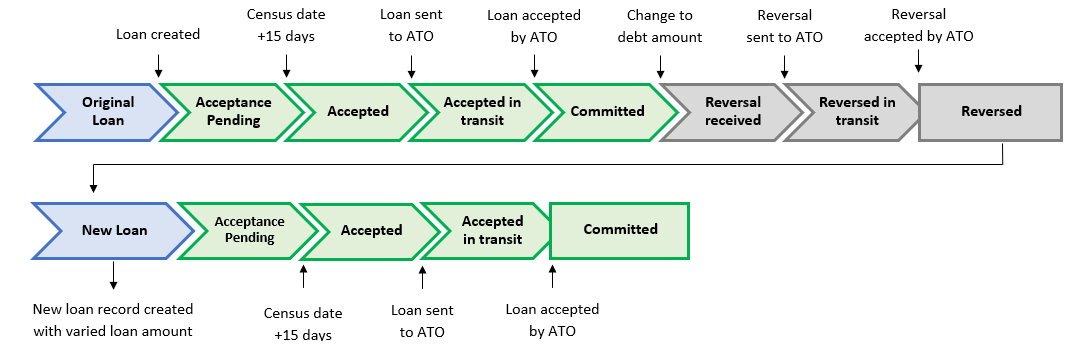

Example 12: Loan value increased or decreased after COMMITTED at the ATO

When a student’s loan has been COMMITTED at the ATO and a provider either increases or decreases the value of the loan by any amount, two records will be created in TCSI.

In this example, the loan was serviceable and the debt amount was increased or decreased after the loan was COMMITTED at the ATO. As a result of varying the loan, two datasets are transferred to the ATO, one to remove the original loan amount and the second to reinstate the loan for the updated amount. This will be visible on the student’s account at the ATO.

*VET providers: When a VET loan enters ACCPEND status, loans will be subjected to Stage 4: VSL checks before being released to the ATO.

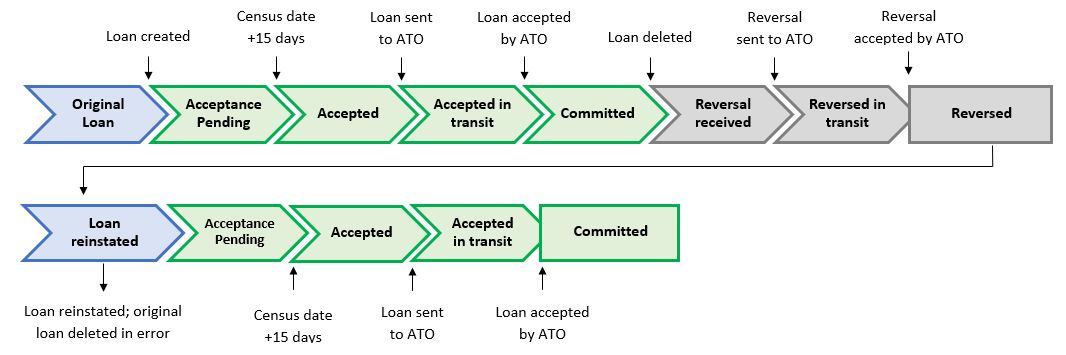

Example 13: Loan deleted after COMMITTED at the ATO and then reinstated

In this example, the unit enrolment was originally reported with a loan amount greater than zero. A loan was created which was serviceable and COMMITTED at the ATO. Then the loan amount was revised to NULL, due to administrative error. Upon discovering the error, the provider re-reported a loan value greater than zero. As a result of the loan amount being revised to NULL and then reinstated, two datasets are transferred to the ATO, one to remove the original loan and the second to reinstate the loan. As above, this will be visible on the student’s account at the ATO.

*VET providers: When a VET loan enters ACCPEND status, loans will be subjected to Stage 4: VSL checks before being released to the ATO.

Transfer of loan data to ATO

For the department to transfer loan data to the ATO data is required for a specific set of elements before TCSI is able to send these loans to the ATO. To support the timely transfer of HELP loans to the ATO it’s essential that data relating to a student and their loan has been reported, a CHESSN has been allocated, the TFN has recently been verified with the ATO and there are non-null, non-blank values for the following elements:

- a verified TFN (E416)

- loan amount (E558)

- student status (E490)

- residential country (E658)

- term address country (E661)

- citizen resident code (E358)

- amount charged (E384)

- amount paid upfront (E381), and loan fee (E529)

- the delivery location country (E660) *HEP only

- the delivery location postcode (E477) *HEP only

- Maximum student contribution code (E392) *HEP only

- residential state (E470)

- residential postcode (E320)

To minimise delays with the transfer of HELP loans please ensure that your organisation is accurately reporting a value for these elements within 14 days of the census date.

Other reasons a loan may not have transferred to the ATO:

- The census date plus 14 days has not passed (it is too early to transfer)

- The loan is awaiting VET approval in VPAYS (monthly payment runs)

- The HECS-HELP loan did not pass upfront discount checks (can also hold up loans with the same census date for the student)

- TCSI is awaiting the reversal of an earlier loan (e.g. if a provider revise the HELP loan amount for a COMMITTED loan, it will need to be REVERSED, before the correct loan amount can be transmitted to the ATO)

The October TCSI webinar outlined more reasons why a loan may not be transmitted to the ATO. Please consult that webinar for more details.