What is StEME?

StEME is the Student Entitlement Management Engine. StEME is a component of TCSI that is responsible for:

- checking that students don’t access more than two OS-HELP study loans

- checking, where a student has two OS-HELP study loans, there is no overlap in the six month study periods the loans are for

- maintaining a ‘loan status’ so providers can see where an OS-HELP loan is in the loan management process

- sending loans to the ATO.

This document provides a high level description of the process used to manage OS-HELP loans and what each ‘loan status’ means.

As OS-HELP loan data is reported, TCSI will undertake a range of real-time validation (RTV) checks. RTVs check that any new data reported by a provider is internally consistent with data that the provider has previously reported. For example, if a provider reported that a student is an international student and then subsequently tries to report an OS-HELP loan for that student, the system will recognise the data inconsistency; will prevent the OS-HELP loan from being stored; and will immediately return an error message to help the provider resolve the source of the error.

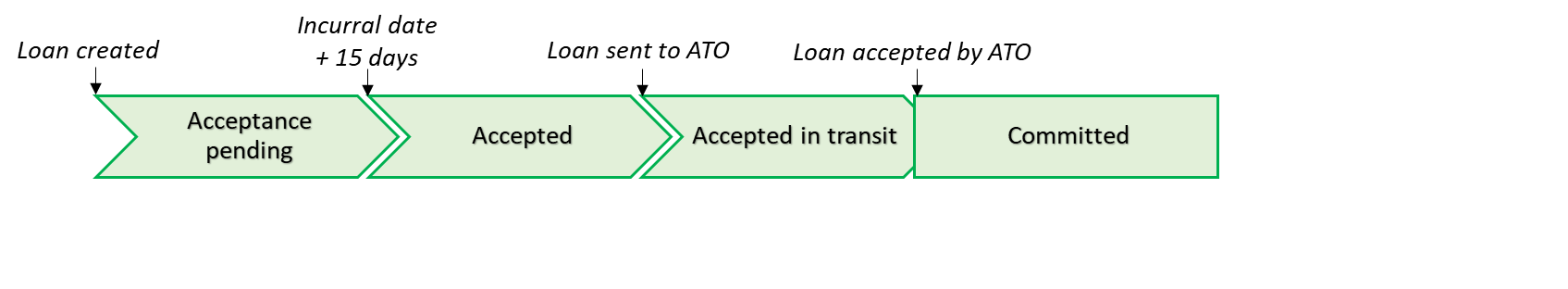

An OS-HELP loan is created as soon as the provider successfully reports an OS-HELP packet with the minimum data elements. At that point, the loan will receive a status of ‘acceptance pending’.

Successfully reports means to report data that passes all the applicable RTV checks and is then stored in the TCSI database.

Once an OS-HELP loan record is created, StEME will check whether a Commonwealth Higher Education Student Support Number (CHESSN) has been verified or issued for the student. A provider must report sufficient identifying data on the linked student record for a CHESSN to be generated before StEME can check whether the student has other OS-HELP loans in the system.

Once the student has a verified CHESSN, StEME will check to make sure that:

- the student does not have more than two OS-HELP study loans, and

- if the student has two OS-HELP study loans, the six month study periods reported in the E521: OS-HELP study period commencement date for those two loans does not overlap.

Where a student has more than one OS-HELP study loan, the loans are placed in an order of precedence based on the HELP debt incurral date. Loans with an earlier HELP debt incurral date have higher precedence. If there are loans with the same HELP debt incurral date, the order of precedence is based on when the HELP debt incurral date was reported or last amended. The validity of loans is then determined as follows:

- The OS-HELP study loan with the highest precedence (this is the first OS-HELP loan) will be assessed as valid.

- Any OS-HELP study loan that has a six month study period that overlaps with the first OS-HELP study loan will be assessed as invalid.

- The OS-HELP study loan that is second in the order of precedence will be assessed as valid as long as its six‑month study period does not overlap with that of the first OS-HELP study loan.

- Any other OS-HELP study loan for overseas study will be assessed as invalid.

An OS-HELP language loan will be assessed as valid if it is linked to a valid OS-HELP study loan. An OS-HELP language loan will be assessed as invalid if:

- it is linked to an invalid OS-HELP study loan, or

- the student already has two valid OS-HELP study loans and the language loan is not linked to either of them (not linked means that either dates match for E583 OS-HELP language commencement date and E521 OS-HELP commencement date do not match).

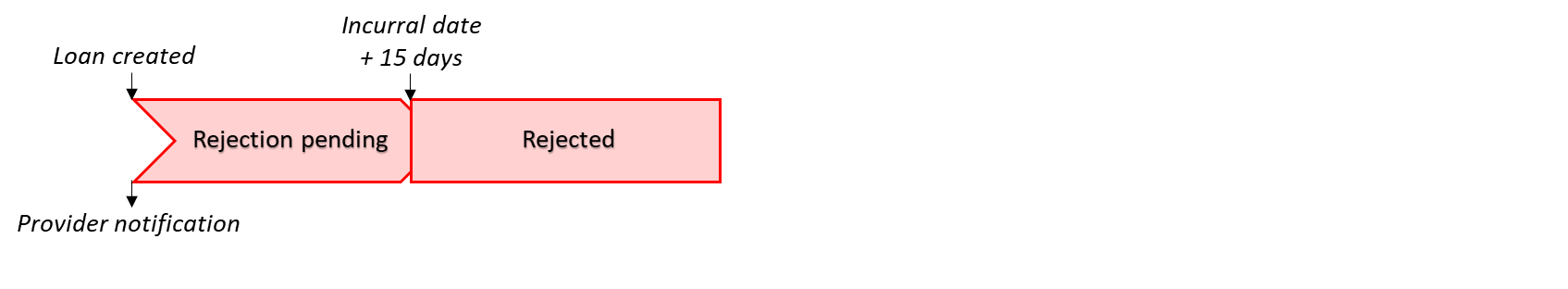

TCSI enables providers to report OS-HELP loans immediately after the HELP debt incurral date. Early reporting is encouraged as this will give providers early feedback on whether loans are expected to be valid or invalid. However, providers have until 14 days after the HELP debt incurral date to report OS-HELP loan data, which means that StEME won’t have a complete picture of all OS-HELP loans for a given date until 15 days after that date. For this reason, loans will have a ‘pending’ loan status until 14 days after the HELP debt incurral date.

| Loan status | Description |

|---|---|

| Acceptance pending |

|

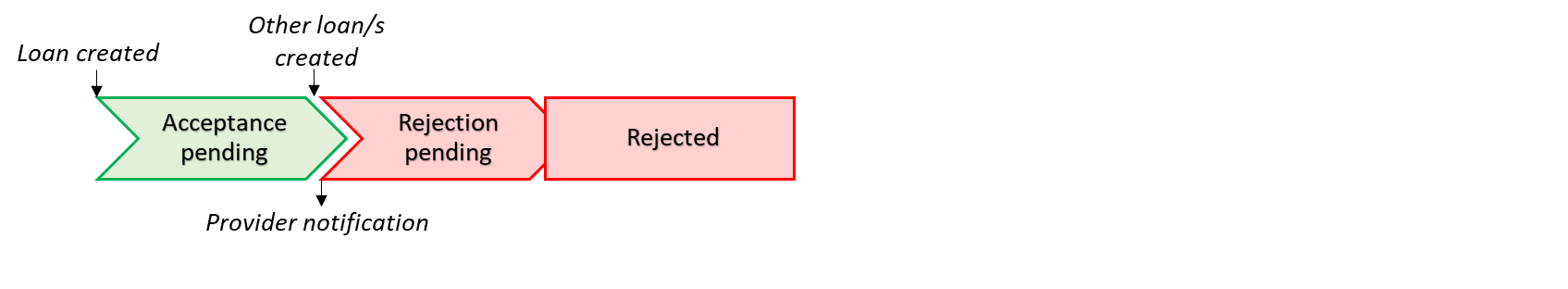

| Rejection pending |

|

| 15 days after the HELP debt incurral date | |

| Accepted |

|

| Rejected |

|

Under the reporting requirements, providers should have reported all data for loans within 14 days after the HELP debt incurral date. This may not always be possible, for example, the student’s Tax File Number (TFN) may not be available if a student is accessing a loan based on an ATO certificate of application for a TFN. Messages will be placed on the provider’s notification table where TCSI identifies that data has not been reported by the reporting deadline.[1]

An OS-HELP loan will be sent to the ATO as soon as the:

- provider successfully reports all the data that is relevant to a student’s eligibility for a loan (such as the citizen resident code) and the data needed to send a loan to the ATO (for example, TFN)

- loan status is ‘accepted’, and

- if the OS-HELP loan is a language loan, the linked overseas study loan has been successfully reported.[2]

The following loan statuses will apply as loans are sent to and received by the ATO:

| Loan status | Description |

|---|---|

| Accepted in transit | The reported loan has been sent to the ATO. |

| Committed | The ATO has acknowledged receipt of the reported loan. |

[1] See TCSI fact sheet: Scheduled Validations

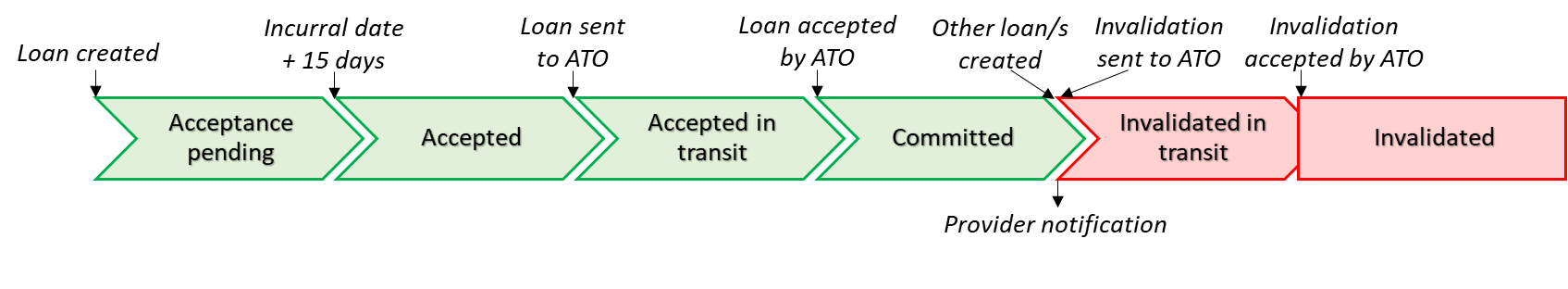

If a provider successfully reports a change to a loan type by amending the student status code (E490) or the HELP debt incurral date, StEME will re-assess the validity of that OS-HELP loan and other OS‑HELP loans the student has with a lower precedence. The loan status will be updated if needed and, if the original loan record was sent to the ATO, StEME will send any necessary amendments to the ATO.

| Loan status | Description |

|---|---|

| Invalidated in transit | The ATO has been asked to remove the loan as it was found to be invalid. |

| Invalidated | The ATO has removed the loan as it was found to be invalid. |

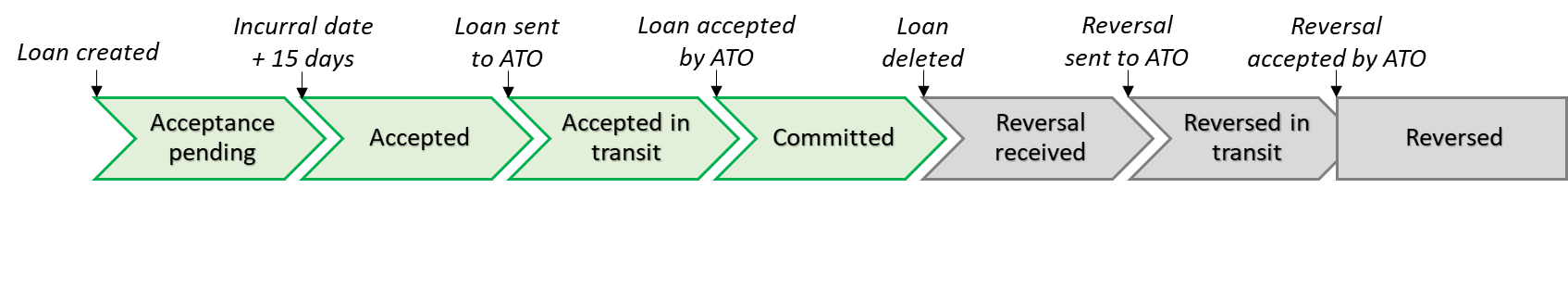

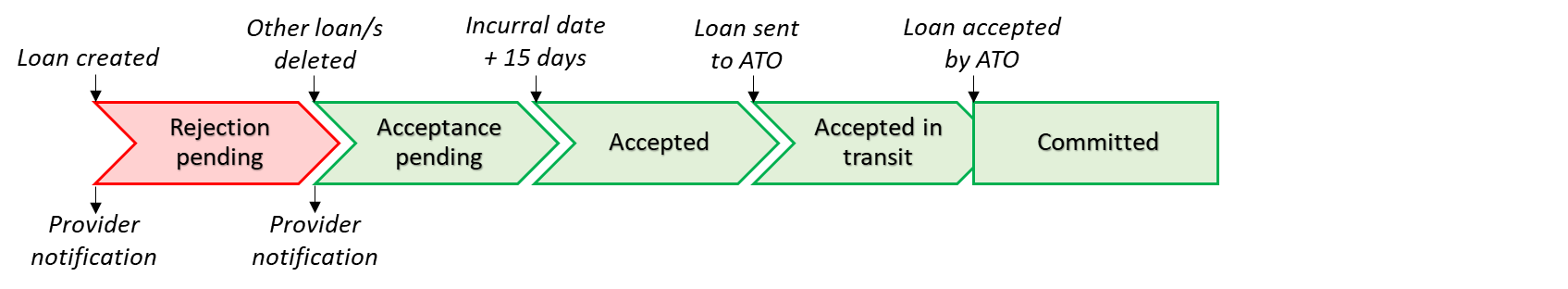

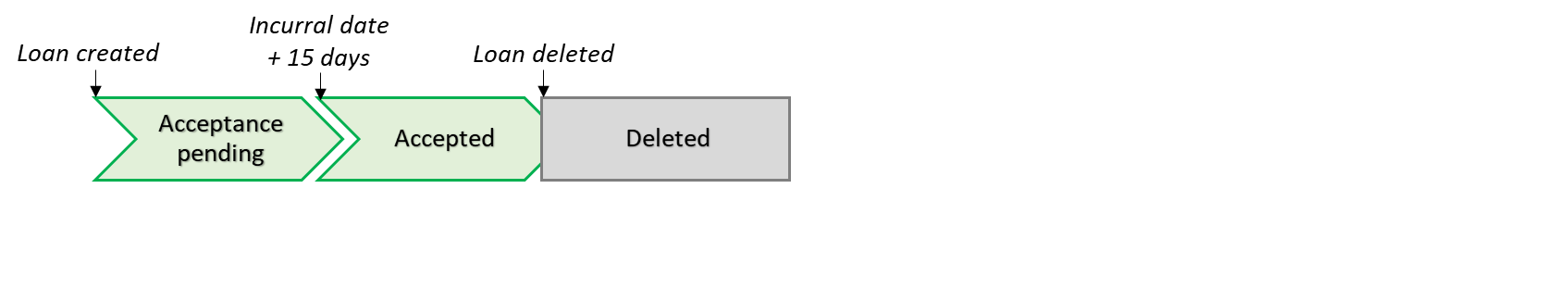

If a provider deletes an OS-HELP loan, StEME will re‑assess the validity of all pending OS-HELP loans with a lower precedence. If the deletion of a loan occurs after the loan has been sent to the ATO, the ATO will be advised and the loan will have a loan status of ‘reversed’. If the loan is deleted before the loan was sent to the ATO, it will retain a loan status of ‘deleted’ and will never be sent to the ATO.

| Loan status | Description |

|---|---|

| Deleted | The loan was been deleted before the original loan was sent to the ATO. |

| Reversal received | The loan was deleted after the original loan was sent to the ATO. |

| Reversed in transit | The ATO has been asked to remove the loan as it was deleted. |

| Reversed | The ATO has removed the loan as it was deleted. |

A message will be placed on the provider’s notification table when there is a change to a loan that the provider needs to know about, including when the:

- loan is assessed as ‘rejection pending’

- status of the loan is downgraded, for example, its status changes from ‘acceptance pending’ to ‘rejection pending’ or ‘committed’ to ‘invalidated’, etc.

- status of the loan is upgraded, for example, its status changes from ‘rejection pending’ to ‘acceptance pending’.

If a provider retrieves the status of a loan, any notifications about the loan status will be deleted from the provider’s notification table.

A message will not be placed in the provider’s notification table for a ‘business as usual’ progression of a loan or for loan changes initiated by the provider. For instance, messages are not created when a loan:

- is created and its status is set to ‘acceptance pending’

- is deleted by the provider

- moves through the loan lifecycle without being upgraded or downgraded as the result of StEME reassessing the validity, for example, the loan status changes from ‘acceptance pending’ to ‘accepted’ to ‘committed’, or from ‘rejection pending’ to ‘rejected’, etc.

For providers using APIs, the loan statuses for each of their loans can be obtained through the Loans API endpoint. For providers using TCSI Data Entry, loan statuses can be obtained through the unit enrolment record.

TCSI Analytics hosts reports that contain the A130 status, such as the Higher Education Unit of Study Unit Records and VET Student Loans Live Data Report reports.

The sooner providers report OS-HELP loans, the sooner StEME can check student loans for validity and the sooner providers will have access to information about whether the loan will be payable by the Government.

Providers have until 14 days after the HELP debt incurral date to report loan data but this is not recommended where it is avoidable. Delays in the reporting of data reduce the amount of time providers will have to identify students who are not eligible for an OS-HELP loan, especially students who may be concurrently enrolled at more than one provider.

Administrative errors that result in the reporting or amendment of loan data more than 14 days after the HELP debt incurral date can have an adverse impact on students and other providers the student may be enrolled with. Providers should note that legislative sanctions are available and may be used where providers frequently report and amend loans data after the reporting deadline.

The following examples show how the loan status changes through the loan life cycle depending on the validity of the loan and loan updates sent by providers.

Example 1: Loan is reported before the reporting deadline and is valid through the loan life cycle

Example 2: Loan is reported before the reporting deadline and is invalid through the loan life cycle

Example 3: Loan started as invalid but the deletion of other loans before the reporting deadline made the loan valid

Example 4: Loan started as valid but the reporting of other loans before the reporting deadline made the loan invalid

Example 5: Loan started as valid but the reporting of other loans after the loan was sent to the ATO made the loan invalid

Example 6: Loan was valid but was deleted before the loan was sent to the ATO

Example 7: Loan was valid but was deleted after the loan was sent to the ATO