|

A number of loan processing queries have been received from providers seeking assistance with their loan reporting and transfers of loan data to the Australian Taxation Office (ATO). |

As data is submitted to TCSI, the system performs a range of real-time validation checks to ensure records are consistent and align with legislation. Loans are then created, checked for serviceability, and sent to the ATO. Examples on how a loan status can change over time can be found at Loan processing for HECS HELP, FEE HELP and VSL loans under the heading Example of loan life cycles. We have now introduced new scenarios to the Example of loan life cycles to cover variation to loans.

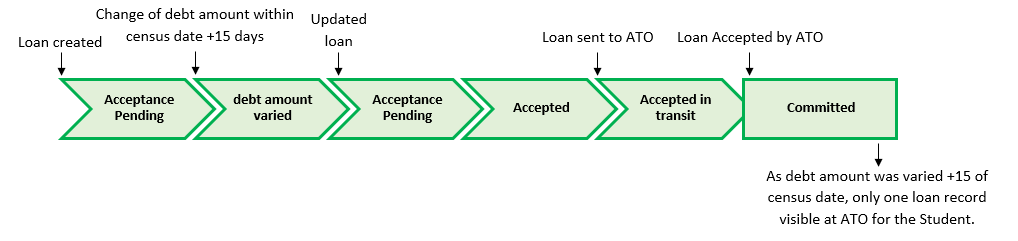

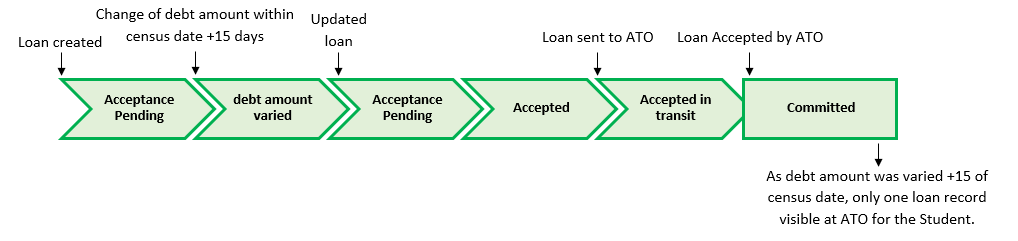

Loan varied within 14 days of the census date

In this example, the loan amount is increased or decreased within 14 days of the census date while the loan was still in ACCPEND or ADJPEND status and had not been COMMITTED at the ATO.

As the variation occurred before the loan was sent, only one record for the loan will be visible by the student when checking at the ATO.

Loan varied after COMMITTED at the ATO

A change to a unit enrolment record that changes or reinstates a loan will trigger TCSI to create a new loan record. TCSI will not update a final loan status. The list of final loan statuses can be found at Loan status (A130) codes. Where a unit enrolment has more than one loan status, the loans with a ‘final loan status’ will not be current.

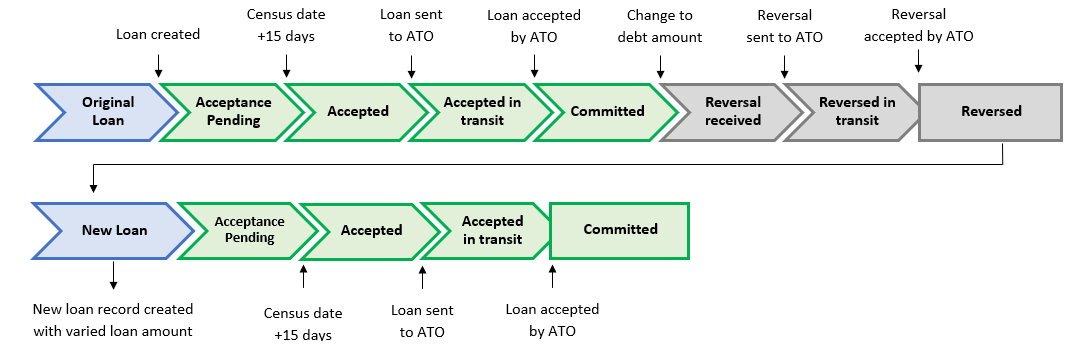

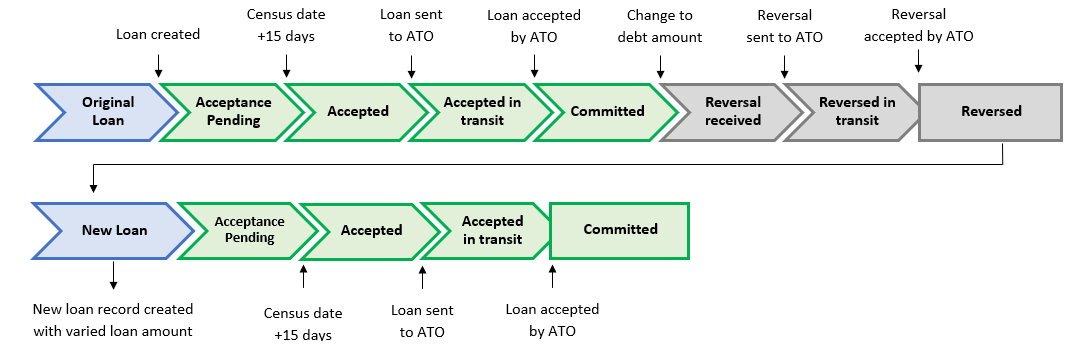

Loan value increased or decreased after COMMITTED at the ATO

When a student’s loan has been COMMITTED at the ATO and a provider either increases or decreases the value of the loan by any amount, two records will be created in TCSI.

In this example, the loan was serviceable and the debt amount was increased or decreased after the loan was COMMITTED at the ATO.

As a result of varying the loan, two datasets are transferred to the ATO, one to remove the original loan amount and the second to reinstate the loan for the updated amount. This will be visible on the student’s account at the ATO.

*VET providers: When a VET loan enters ACCPEND status, loans will be subjected to Stage 4: VSL checks before being released to the ATO.

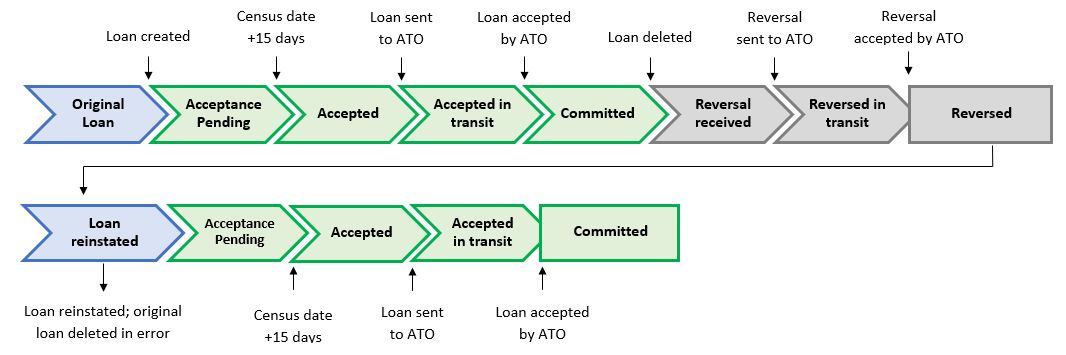

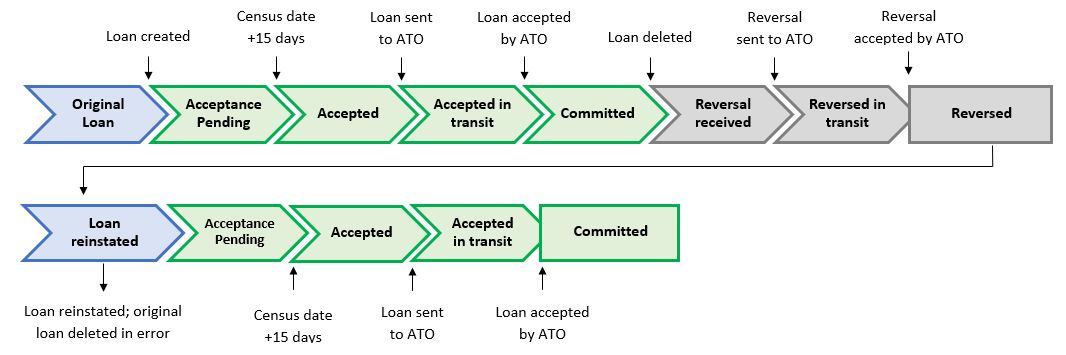

Loan deleted after COMMITTED at the ATO and then reinstated

In this example, the unit enrolment was originally reported with a loan amount greater than zero. A loan was created which was serviceable and COMMITTED at the ATO. Then the loan amount was revised to NULL, due to administrative error. Upon discovering the error, the provider re-reported a loan value greater than zero.

As a result of the loan amount being revised to NULL and then reinstated, two datasets are transferred to the ATO, one to remove the original loan and the second to reinstate the loan. As above, this will be visible on the student’s account at the ATO.

*VET providers: When a VET loan enters ACCPEND status, loans will be subjected to Stage 4: VSL checks before being released to the ATO.

Whilst providers are encouraged to continue early reporting; data needs to be correct and accurate within 14 days of the census date to ensure loan transactions are clear to students.

Change to the display of SA-HELP Loans

The department is now providing more helpful information to students viewing SA-HELP loans on their Australian Taxation Office (ATO) record. Students accessing a SA-HELP loan will now see their loan description as 'New loan for HELP for SA-HELP at [provider name]'. This will reduce confusion for students undertaking multiple courses or transferring between courses.

This change only applies to new loans. SA-HELP loans that were committed at the ATO before 8 July 2022 will retain their description including a course code that matches a course admission for the student.

For information regarding loan processes in TCSI, please see the information on our loan processing guides below: